Smartphones have become the most commonly used and the most private device in the market. They are used to contact other people but also to take photos, record videos, listen to music, write to friends and families via instant messaging, work… And also to pay. Mobile payments are slowly entering our lives. To a large extent, this pace of change is due to the large penetration of cash and card payments. Nevertheless, almost all experts believe that this will be the most commonly used method of payment in the future.

Total Retail 2016 is one of the latest reports on the penetration of mobile payments. It contains interesting information about 25 countries, including Spain. In the specific case of Spain, 77% of respondents mostly pay in cash, 56% pay with debit cards, 51% pay with credit cards, 43% use bank transfers and only 8% use their smartphones. In fact, 58% of Spaniards stated that they have never made a purchase through their tablet and 55% said that they had never used their cell phone for this purpose. Spanish consumers prefer other new methods such as PayPal and virtual cards to shop online.

This text is a summary of the current status of mobile payments in some of the main countries in the world, including Spain: Esto pretende ser un resumen del estado de los pagos móviles en algunos de los principales países del planeta, incluidos lógicamente los consumidores españoles:

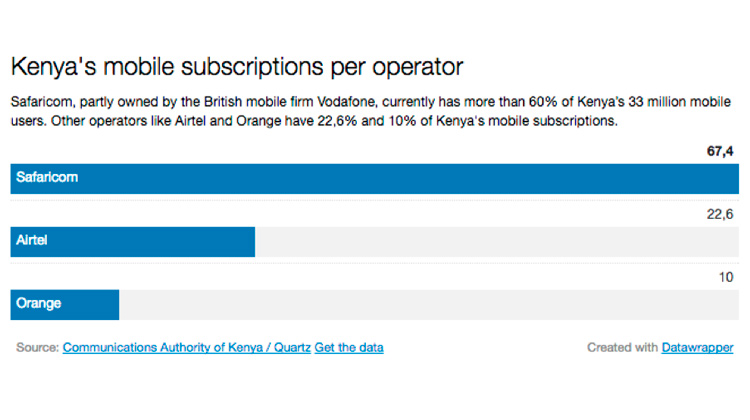

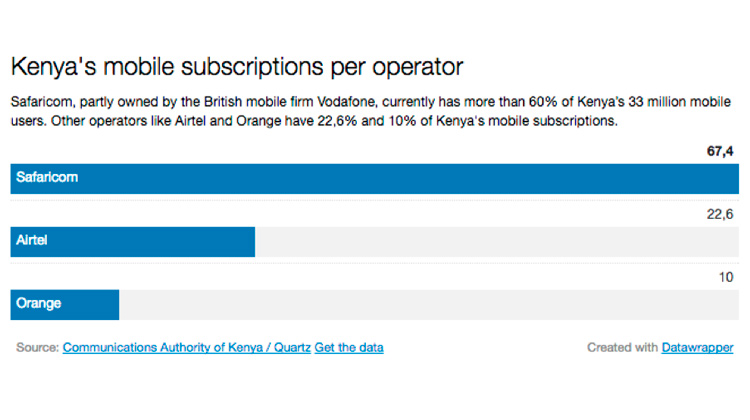

1. M-Pesa, a success story from Kenya

The only case of mass success in using cell phones to pay for cargo or services comes from Kenya. M-Pesa (M stands for mobile and “Pesa” stands for money in Swahili) is a mobile product offered by Safaricom, Vodafone’s subsidiary in Kenya. M-Pesa allows users to pay and top up their mobile balance, send money to users and non-users, withdraw money from ATMs, etc. Its success is derived from being a system that leads to bancarization without having to open branch offices. The idea is for it to expand to the rest of Africa through such countries as Uganda, Tanzania, South Africa, the Democratic Republic of Congo, Mozambique, Lesotho and Ghana. This system can also be found in Egypt (Asia) and Romania (Europe).

With the aid of payment processors such as M-Pesa, almost 60% of Kenya’s population uses their cell phones to make all kinds of payments and collections. They have been provided a service they had asked for through a device they were familiar with, the cell phone. This system has reached people that were outside any financial circuit. In March 2016, M-Pesa registered a 27.1 per cent growth in active users in Africa, Asia and Europe and totaled around 25 million susubscribers the world.

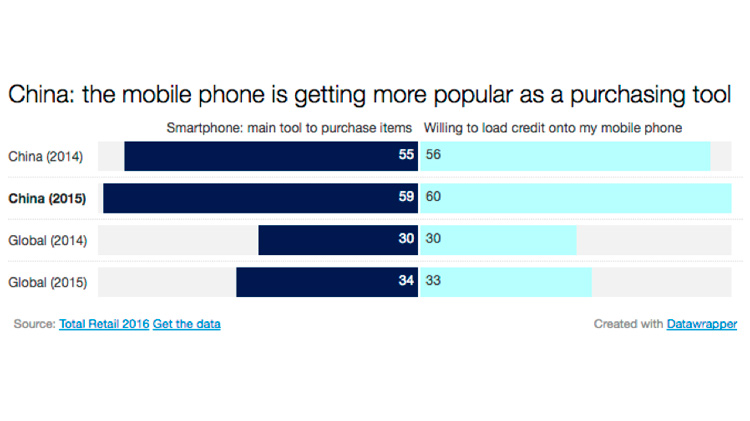

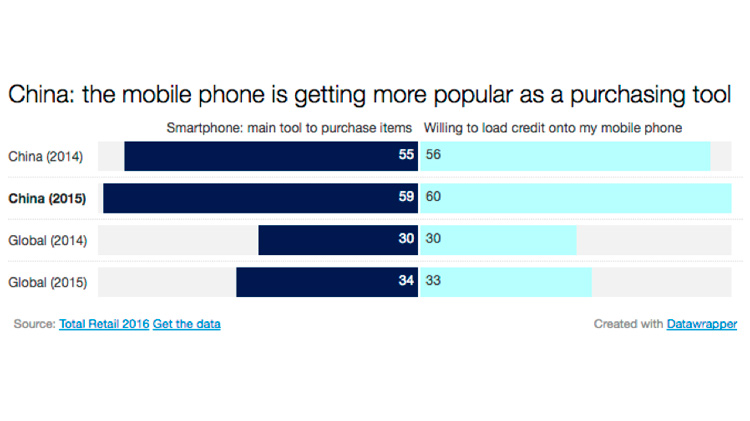

2. China, an example of mobile payments evolution

Experts always say that China is a perfect example of how mobile payments will evolve worldwide. In some way, this is the microclimate that foreshadows the natural progress of consumer habits as regards mobile payments. This chart shows an almost identical growth behavior among consumers in China and the rest of the world as refers to using their cell phones as their payment method of choice, or their willingness to load credit to their smartphone.

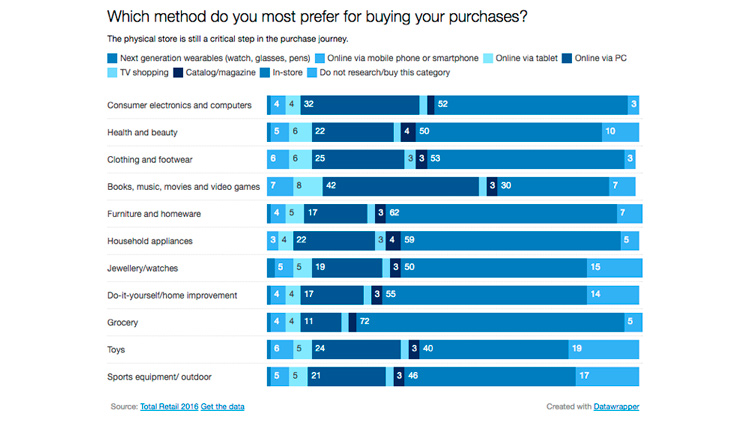

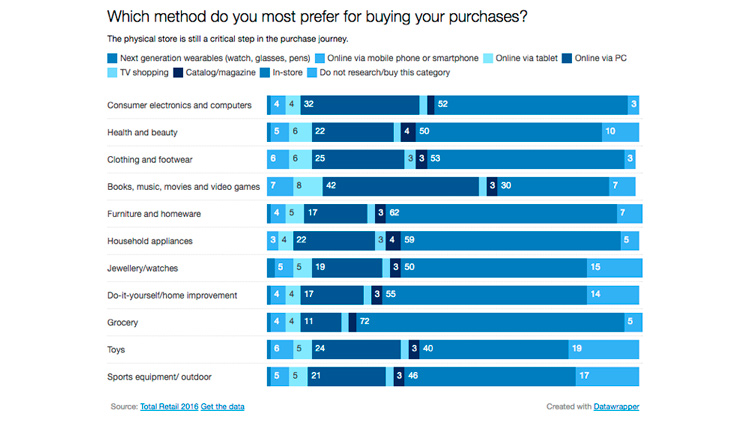

3. Mobile payments? Physical stores and online through your PC

This is a good chart that shows the actual penetration of mobile payments and indicates the favorite method of payment for products and services. The type of product is the least important factor. The most interesting fact is the trend shown by percentages. Based on data from Total Retail 2016, the following chart lists the physical store as the favorite method of payment, followed by online purchases via PC. The least common method is also the most recent one, i.e. wearables such as smart watches or glasses, followed by online payments using cell phones. Mobile payments have not yet become one of consumers’ favorite channels.

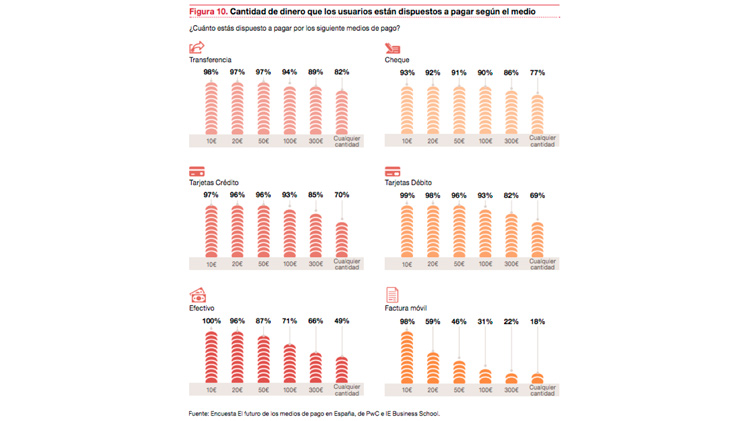

As for Spain, the study “Los medios de pago, un paisaje en movimiento” on methods of payment (carried out by the Financial Sector Center at PricewaterhouseCoopers and by the IE Business School in June 2015) places mobile payments (wallet on smartphone) behind other methods: cash, cards, transfers, checks and applications. This chart is particularly interesting since it also divides the information by age range.

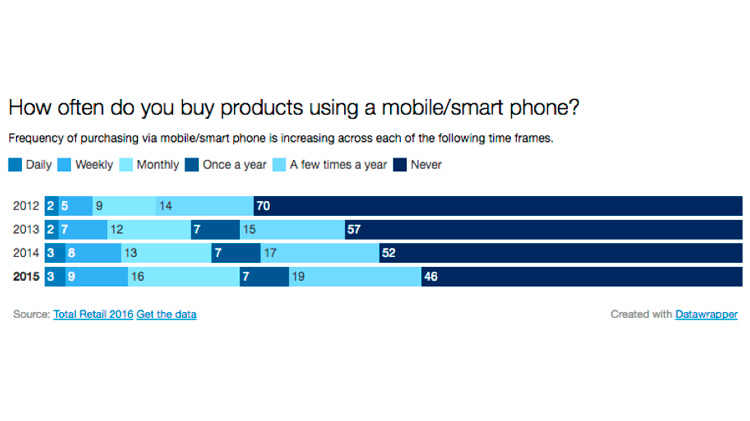

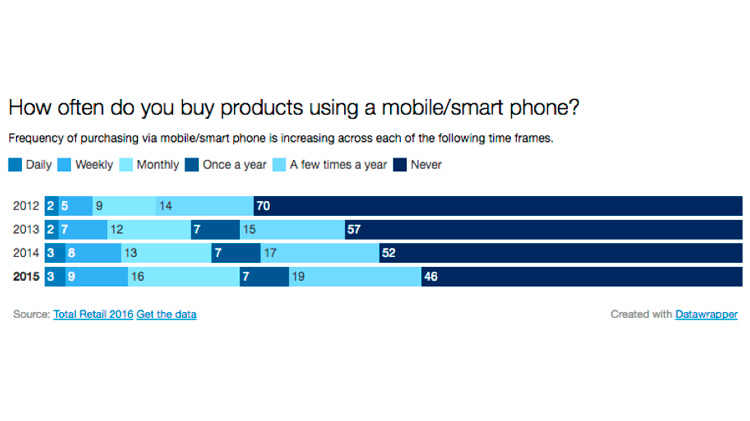

4. Frequency, an interest aspect

One interesting piece of information when you measure the progress of consumer habits and the gradual penetration of mobile payments is the frequency with which this method is used. When compared with total figures and the percentage of mobile payment use, the frequency with which smartphones are used to buy products and services represents a quality rather than a quantity metric. Total Retail 2016 shows a major evolution: in 2012, 70% of consumers said that they did not use their mobile devices to shop, while 46% of consumers said the same in 2015.

Experts expect that, by early 2019, 80% of consumers will use their cell phone to make a purchase at least once a year. An example of this natural evolution is the type of traffic received by major online retailers on their platforms – most of this traffic is from mobile devices. Las previsiones de los expertos señalan que, a comienzos de 2019, el 80% de los consumidores usará el teléfono móvil al menos una vez al año para hacer algún tipo de compra. Ejemplo de esta evolución natural es la tipología de tráfico que reciben los grandes retailers online en sus plataformas: en su mayoría es móvil.

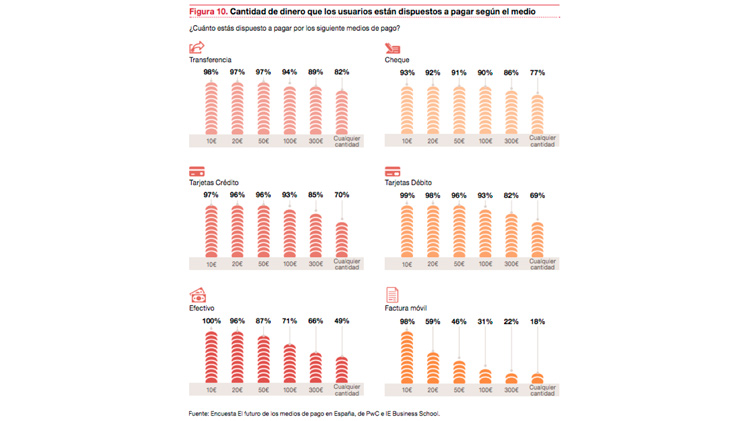

5. Another quality metric: amount by method

Another way of measuring the progress of mobile payments refers to the amount of money that consumers are willing to pay depending on the method of payment. In this case, mobile payments still offer few guarantees to users. However, this is less to do with a sense of lack of security and more to do with the fact that this is a new method and consumers are not used to using it. The following chart shows how much money users are willing to pay by method, according to PWC.