A large part of the industry, with years of experience training their teams, designing their strategies and operating their business niches, either voluntarily or under obligation, are having to adapt to new market conditions. One of the most frequent shifts in this industry, including retail and investment banking, is how artificial intelligence can be used as a competitive edge to earn money old- and new-style.

Methods like machine learning and deep learning are helping entities in many different operational fields. Logically, APIs specializing in machine learning and deep learning are the starting point for any transformation. They allow banks to create finalist products that create value for the entity and its customers: they allow extracting important information from Big Data, searching for patterns to tailor offers, price corrections and detecting bank fraud processes.

These days there are application development interfaces that feature natural language processing or image and voice recognition (deep learning) and predictive modeling to make estimates (machine learning). This can be applied in practice: product and customer definition (knowing which services are of interest to each user through customer segmentation); risk management (lending always associated with the possible default); and anti-fraud techniques.

All of this is possible due to the natural evolution of data equipment in banks: from business intelligence (SAS Add-ins, Excel and PowerPoint) to data science machines (language programming, for example R, Python and Scala); data visualization with JavaScript libraries such as D3 and dashboard software such as Tableau; the open source distributed computing platform Apache Spark; or the data storage system Apache Hive, with Apache Hadoop, to view and analyze data using HiveQL.

Product Definition

The three key questions in using machine learning for product and service definition and the necessary customer segmentation is where are banking users coming from, where are they now and where are they going. A predictive model must be built which can be interpreted by the operations teams, with the customer at the core of the business logic, and which leads to specific actions. The idea is to define services that are adapted to customer needs and interests, by studying consumer habits and the channels where banking users show the most commitment.

Risk management

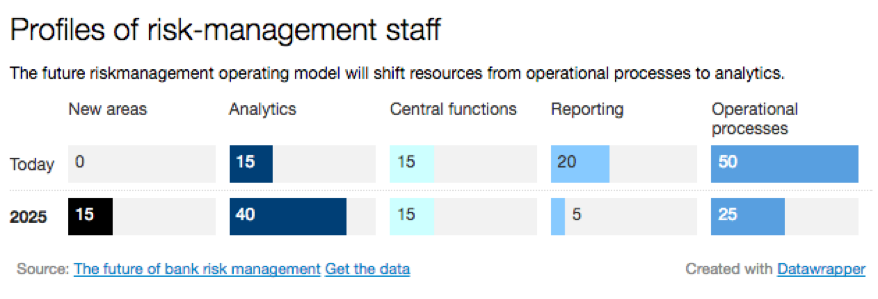

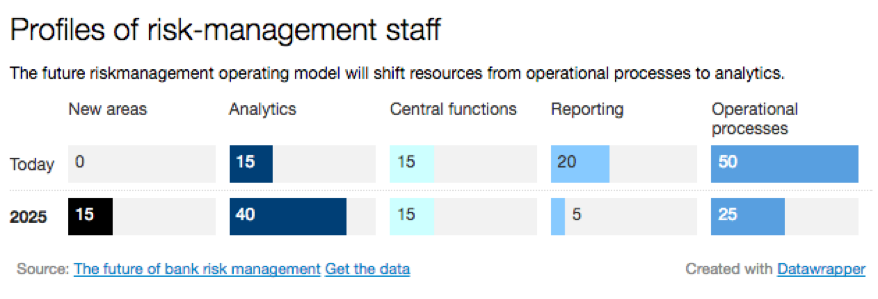

The 2007 global crisis had far-reaching consequences on how financial and investment entities and retailers calculated the risk involved in their business transactions. A recent report by MacKinsey&Company establishes an interesting change in concept: while these days only 15% of bank risk control falls with analytics, by 2025 that percentage will rise to 40%. These changes are always progressive and, as the analysis shows, banks do not need to wait, they can already apply machine learning processes.

This shift of resources in risk management is shown clearly in the following chart, which explains how banks will change structures to assume the new challenges of the new model, based on Big Data technology as machine learning:

Not only will more resources be allocated to early risk detection and not so much to problem solving. This is a strategic decision with a huge impact. Teams will also receive training or external talent will be sought to combat the new forms of bank risk, mainly cyber attacks. Cybersecurity has become a strategic goal for companies and within the financial sector it is a department of great value.

Anti-fraud techniques

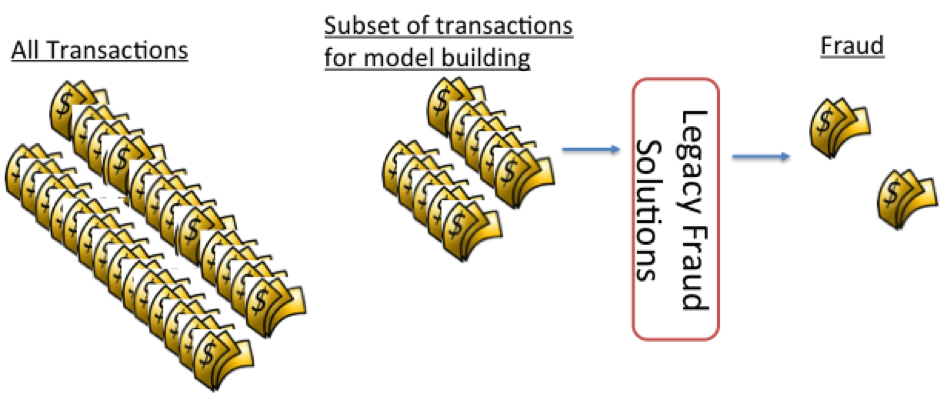

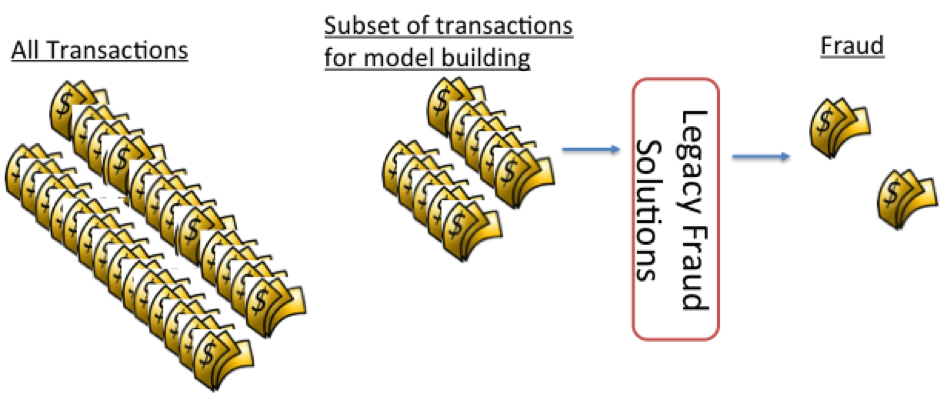

The use of machine learning to prevent fraud is based around methods that can be divided into two general groups: supervised learning and non-supervised learning. In machine learning methods, the machine learns to detect abnormal behavior using a random data subset, which is classified as fraudulent or not. By successively repeating this information processing, the machine improves its predictive capacity and can prevent possible fraud.

The most commonly-used supervised learning methods in this case are supervised neural networks and fuzzy neural networks to prevent both over-the-phone fraud and credit and debit card fraud.

Non-supervised learning, unlike supervised learning, does not include a sample data set that allows machine learning, instead the method aims to identify patterns or similar characteristics to create subgroups for the total data volume. They are common methods like Bayes networks and Markov Hidden Models to establish probabilities and reduce the uncertainty over whether financial fraud has actually been committed.

This is important because, these days, most banks around the world focus their fight against anti-fraud on creating pattern models from subsets of past transactions. Therefore, banks have a low capacity to prevent fraud committed for the first time and in real time. Also, those historical models are not properly up-to-date due to cost reasons. Another important factor is weighing up customer satisfaction: financial entities always carefully consider canceling supposedly fraudulent transactions due to fear of upsetting the customer who, unlike what the predictive model says, performed a legal transaction.

Some financial entities have specialized in solving such problems. Brighterion is one of the fintechs that currently stands out due to its machine learning services to prevent credit card fraud, for example. The company’s products combine up to 10 artificial intelligence technologies, allowing the machine to learn, predict and take decisions in real time. It is a cognitive computing platform. Brighterion includes four anti-fraud products:

● iPrevent: the platform can register and learn the behavioral and consumer habits of the owner of any credit cards issued by a bank. The objective: establish red lines which detect possible abnormal behavior when using those cards.

● iDetect: this can detect the violation of personal or security data related to credit cards and irregular transactions.

● iPredict: risk prevention tool for bank credits.

● iComply: uses non-supervised learning processes to detect international money-laundering. The platform receives data from different sources, always in real time, analyzes the data and monitors the money flow between customers and organizations to prevent the laundering.

If you want to try BBVA’s APIs, test them here.